A durable financial power of attorney can avoid financial disaster in the event you become incapacitated. You can also use a POA to allow someone to transact business for you if you are out of town or otherwise unavailable.

Learn more about Power of Attorney

by LegalZoom staff

Updated on: February 9, 2024 · 12 min read

Financial power of attorney (POA) gives another person the ability to conduct your financial matters when you cannot be present.

In this article, we'll discuss the definition and importance of a POA, the types you can choose from, and how you can make a POA for financial purposes by yourself.

power of attorney." width="1000" height="567" />

power of attorney." width="1000" height="567" />

A financial power of attorney is a legal document that authorizes an agent to act on your behalf in financial matters. Financial POAs function as proof that the designated agent has the power to manage the principal's finances.

See an example snippet of a financial power of attorney below. A standard financial POA should include the:

The components listed above are standard nationwide for creating a power of attorney for banking. However, different states may require additional information. Check your state's website for more information about their legal requirements for POAs.

Once principals execute the power of attorney document, they give the original to their agent, who may present it to a third party as evidence of the agent's authority to act on your behalf.

A financial POA grants agents the power to carry out finance-related tasks, such as withdrawing money from your bank account or signing papers for you at a real estate closing.

For an agent to use a financial POA:

Your agent may do as much or as little as you wish, depending upon the powers you grant in the POA. If the agent is disinterested in being your agent, rescind their power. Otherwise, they're free to decline the role as your attorney-in-fact by tendering a written resignation letter.

Some people grant an agent the authority to handle all financial matters, while others only authorize a single financial transaction (such as signing documents at a real estate closing).

It's your right to select which powers you wish to grant and to whom. See our comprehensive list of traditional agent responsibilities for financial POAs below.

The authority conferred by a POA always ends upon the principal's death. The agent's authority also ends if the principal becomes incapacitated—physically or cognitively unable to make their own decisions—unless the POA states otherwise.

Additionally, the agent's authority ends if you revoke it, if a court invalidates it, if your agent can no longer serve, and you haven't appointed a successor, or—in some states—if your agent is your spouse and you get divorced.

If the authority continues after the principal is mentally or physically incapacitated, the agent will need a durable power of attorney (or DPOA). This document will prevent someone from having to go to court to be appointed the guardian of your property (some states refer to this as conservatorship).

Generally, a third party is not required to accept a power of attorney. A third party is any person or business that assists with financial management and transaction but isn't listed in the POA and represents someone other than the principal.

Some state laws enforce penalties for businesses and third parties that refuse to accept a power of attorney using the state's official form. You can help assure its acceptance by contacting anyone you think your agent may need to deal with and ensuring they find your POA acceptable.

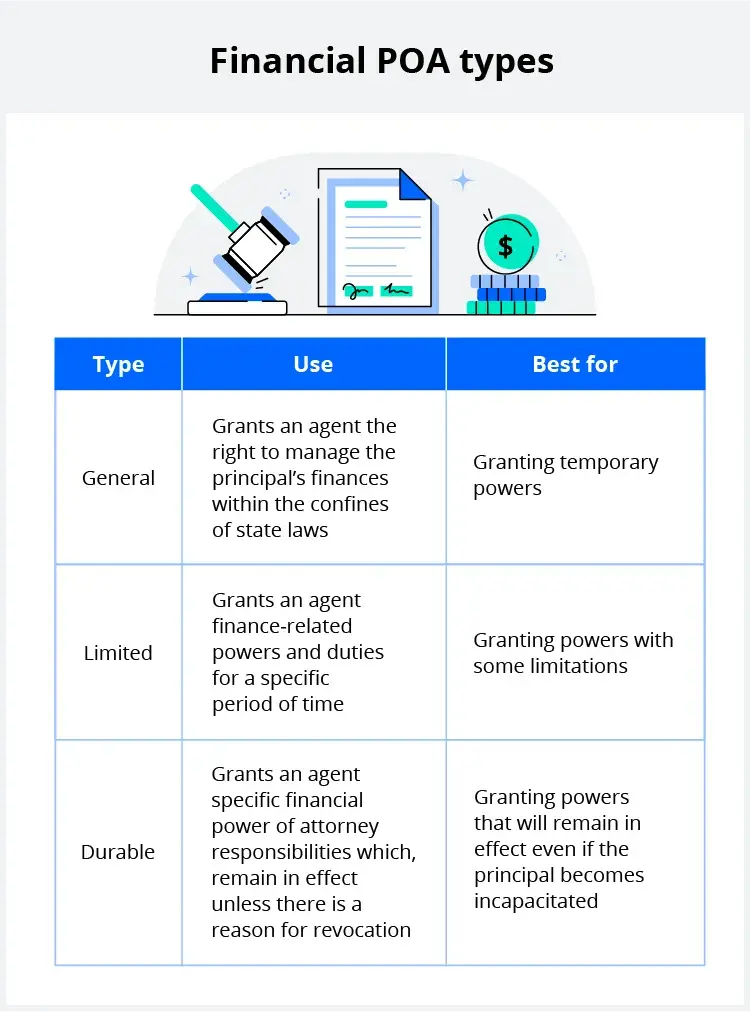

The three types of financial POAs are general, limited, and durable. While all financial POAs serve the purpose of ensuring that your money, property, and investments are well-taken care of—the type you select dictates how much power your chosen agent holds and when their responsibilities take effect.

This type of banking power of attorney grants your agent the right to handle all of your finances within the confines of state laws. In most states, they can manage your bank account, sign checks, file your taxes, and even sell property.

The only caveat to this financial POA type is that it expires when you, the principal, are no longer coherent, mentally capable as determined by a qualified health care professional, or die.

For that reason, this isn't always the best option for those who are elderly or ailing and may need help managing their finances when they're no longer able. However, it is a strong option for people who intend to take recurring trips and is a popular choice among those serving in the military.

A limited financial power of attorney is a legal document that outlines who the principal has allowed to carry out certain asset-related tasks. For example, if you welcome help with paying bills and depositing checks but don't want to give your agent the power to make withdrawals or sell your property, this type of POA cements your wishes.

Limited POAs can take effect immediately and are time-bound. Generally, it will expire when the principal no longer needs finance management assistance.

This is a good option if you will be traveling or have temporarily limited mobility.

The durable financial POA (DFPOA) remains in effect even if the principal is mentally incapacitated, has Alzheimer's disease, is in a coma, or is otherwise incapable of advocating for herself or himself. This makes it an option that the elderly and terminally ill prefer.

Like a limited POA, the principal can detail who can access their finances and any limits to their responsibilities. If the principal decides they don't want the POA to go into effect immediately, they can create a springing POA and describe the events or level of incapacitation needed before it goes into effect.

Generally, a financial power of attorney must be signed before a notary public, especially if the sale or purchase of real estate is involved. It may also need to be signed before witnesses. In a few states, the agent must also sign to accept the position of agent.

Regardless of your state's unique requirements, you can write your own financial POA or use a financial power of attorney form.

Before you get started, review your state's guidelines for information about the following requirements:

Gathering this information ahead of time helps ensure you have everything needed to create a legally binding power of attorney document.

Once you've selected a reliable agent to help manage your finances, adding them to your POA is simple (as long as they meet your state's requirements):

Generally, the only information you need to grant them the power to assist with your finances and banking is their:

You can add multiple agents to your power of attorney if that's your preference. Just be sure to clearly outline their respective duties to avoid confusion. If there are instances where you expect them to come to an agreement or want one person's opinion to take precedence, you should also note that.

Selecting agent powers is one of the most important components of a financial POA because it clearly describes their scope of responsibility and adds a layer of protection for you.

Some common responsibilities include:

When it comes to money, you can never be too careful about protecting yourself. Even a well-intentioned agent can make serious mistakes. That's why it's crucial to put certain checks and balances in place.

To prevent any abuse of power or other crisis, ask yourself these questions during the POA planning process:

Include your answers to these questions in your POA.

Decide if you want the financial POA to go into effect immediately, at a certain date, or if you become incapacitated. This will determine the type of POA you create:

Once you finalize your POA, you should get the necessary signatures, give your agent a copy, and file the original away for safekeeping. Depending on your state, you may also have to notarize the document and file it with a government office. Check your state's requirements, because standards vary widely across the U.S.

Finally, if you only appoint one attorney-in-fact, we recommend disclosing the location of the original financial POA form to a trusted friend or family member in case you ever become incapacitated.

There isn't a standard POA form or requirements used in all 50 states. However, many states have an official durable power of attorney form available for download (usually a durable financial power of attorney form).

Some banks and brokerage firms do have their own power of attorney forms, but you can defer to your state's financial POA form as long as bank-owned property such as a car or house isn't involved.

Here are the requirements for finance POAs in the highest-searched states:

The only legal requirements to be an agent are that the person is of sound mind according to a health care professional and at least 18 years of age. If there is evidence the agent doesn't meet these requirements, the courts can assess the contract's validity.

It is essential that your agent be someone whom you trust totally. Your agent has the legal obligation to act in your best interest, to keep records of transactions, not to mix your property with theirs, and not to engage in any conflict of interest.

Some other factors to consider aside from trustworthiness include the agent's:

Whether you plan to be away for a while, will be out of commission due to health issues, or just want to get a jump-start on your future, a financial POA is one of the primary legal documents you should create to protect your estate. Start writing your POA today and connect with an attorney in our network for easy access to answers about estate planning.

Learn more about Power of AttorneyThis article is for informational purposes. This content is not legal advice, it is the expression of the author and has not been evaluated by LegalZoom for accuracy or changes in the law.

You may also like

By knowing what other trademarks are out there, you will understand if there is room for the mark that you want to protect. It is better to find out early, so you can find a mark that will be easier to protect.

July 31, 2024 · 4min read

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

July 21, 2024 · 11min read

A power of attorney can give trusted individuals the power to make decisions on your behalf—but only in certain situations.

August 29, 2024 · 20min read